Nomad Blog

Back to all posts

The Landlord's Guide to the Current Real Estate Market (2022)

Published on: Jul 27, 2022

The real estate market is changing.

It's challenging to keep up with the current state of things thanks to fast-evolving factors like remote work, post-pandemic trends, international conflict, inflation, home supply constraints, and consumer interest.

As a landlord, you need to be in the know.

Do you keep doing your thing, or should you look at capitalizing on high home prices? Should you raise the rent for your tenants, or do you increase the length of your contracts? Is now the best time to purchase an additional investment property, or should you wait and see how things play out over the next few months or years?

So many questions and so few answers.

While we don't have a one-size-fits-all answer for every landlord out there, we do have insights into the current real estate market. Below, we've collected data detailing everything you need to know about the current US real estate market. Based on that data, we've compiled predictions (not guarantees) for what we believe will happen in the near future.

Lastly, we discuss the pros and cons of different strategies you can use to successfully navigate current market conditions. Ready to deep dive into the turmoil that is the 2022 real estate market? Take a deep breath—it's going to be a rough ride.

State of the Real Estate Market in 2022

The summertime market is cooling off for sellers, but make no doubt—it's still a seller's market. Home prices aren't dropping, but they are rising at a slower rate.

Thinking of Selling Your Property?

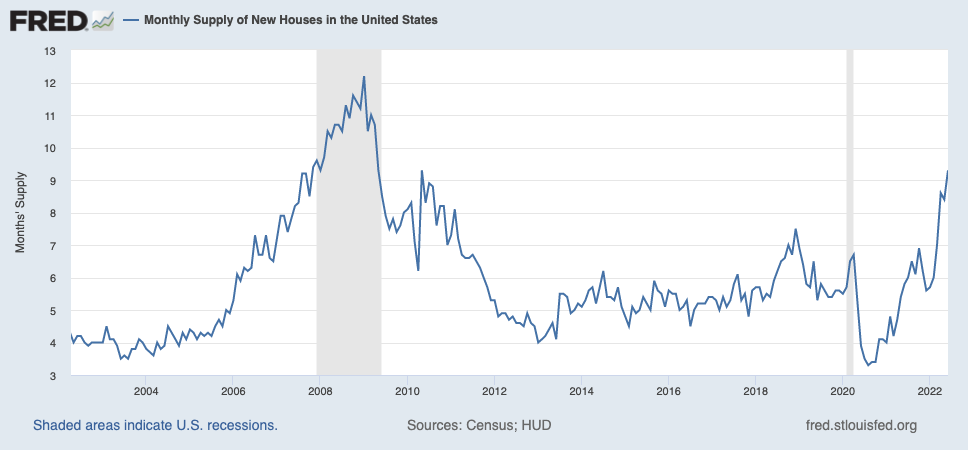

The months' supply ratio shows that housing supply should grow to the highest it's been in a decade, but supply can’t keep up with increasing demand (and that's why home prices aren't dropping—just slowing).

Federal Reserve Bank of St. Louis

And it's not hard to see why.

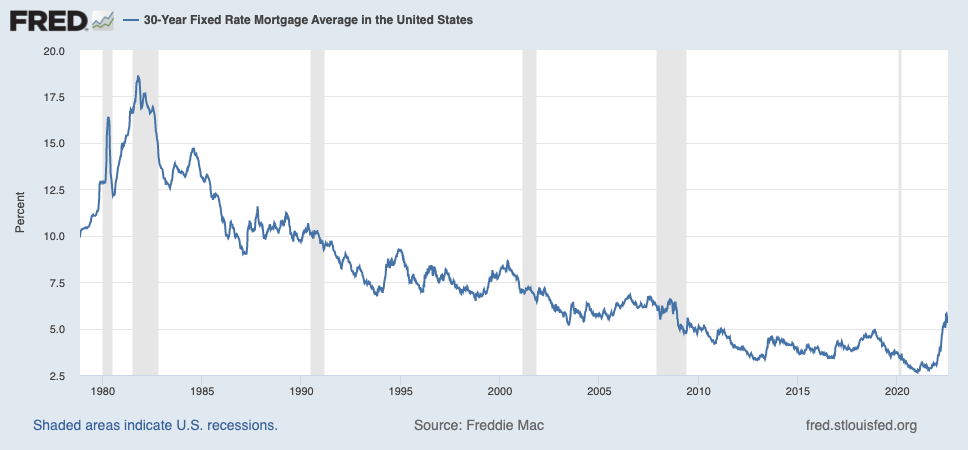

A 9.1 inflation rate in June (the highest we've seen in 40 years) is leading the Fed to increase interest rates, driving mortgage rates through the roof. That's relatively speaking.

Mortgage rates might be 2x higher than they were by the end of 2021, but they are still lower than practically the entire first decade of the 21st century.

Federal Reserve Bank of St. Louis

Home prices just hit record growth in May as they reached a 20.6% year-over-year increase (the highest annual price growth in 35 years).

High inflation paired with growing mortgage rates and home prices makes it increasingly difficult for would-be homebuyers to afford a property.

Staying as a Landlord Isn't a Bad Idea, Either

Home prices are still growing, and we don't know when the bubble is going to pop. However, landlords aren't necessarily in a position where they need to sell—the renting market is red hot.

Homebuyers unfortunately have had a hard time affording real estate, meaning they have to rent to find a place to live. More renters in the market lead to decreasing supply, and lower supply leads to higher rent prices—and that's a good position to be in as a property owner facing record-high inflation.

Real estate is one of the most effective hedges against inflation. Sometimes, inflation outpaces your savings account's interest—and that means your money is depreciating in the bank. With inflation, home prices and rent prices tend to go up, too—that’s why it’s smart to keep your money in a cash-flow-generating property.

Plus, if you purchased your property before 2022, you likely locked in one of the lowest mortgage rates. When you buy a new property, you’re not going to score a rate like that anytime soon.

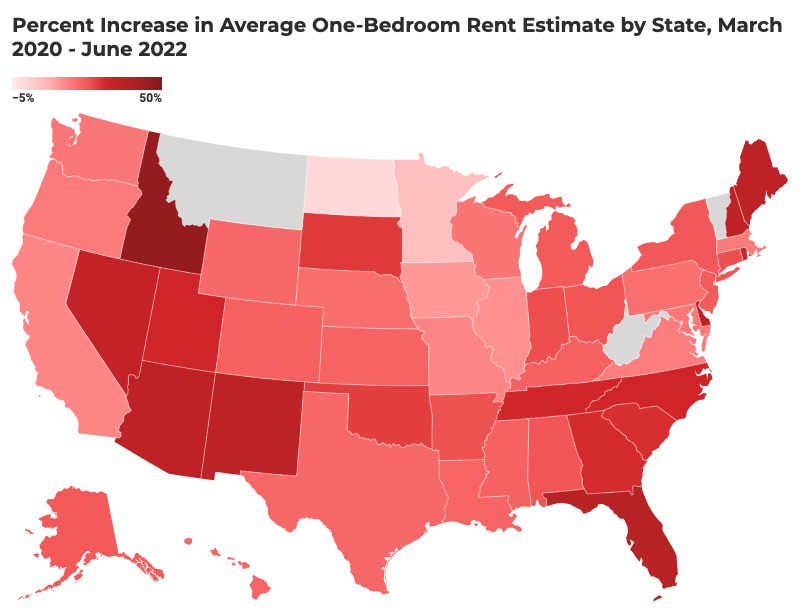

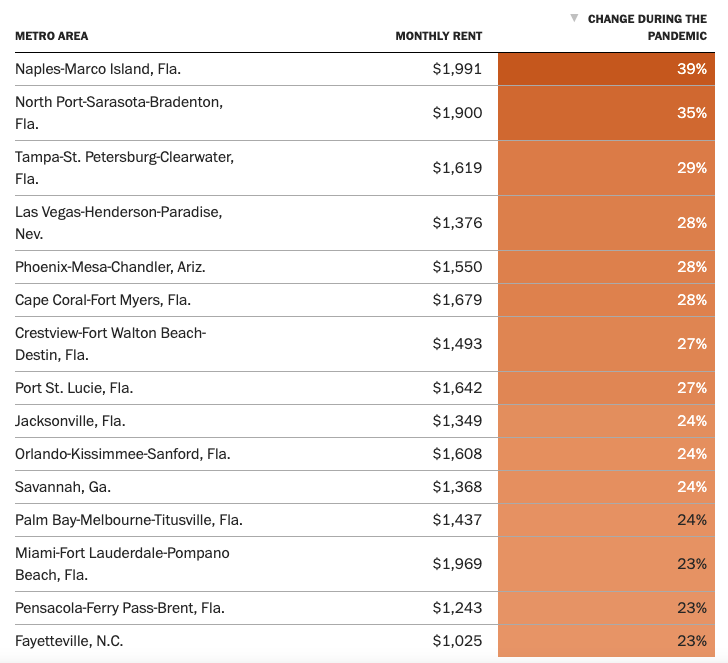

Rent prices are up 25.3% year-over-year for 1-bedroom units and 26.5% for 2-bedroom units. However, those are national averages. Some states are experiencing explosive rent spikes, while others are a bit more moderate.

For example, rent prices have jumped by 45.8% in Idaho since the start of the pandemic, while they've only gone up 14.4% in California.

Thanks to a desperately low rental supply, tenants are now entering into bidding wars (a common home-buying trend in recent years) in the rental market. It's not uncommon in some hot markets to see renters offering 10-15% above the asking price.

New Supply Isn't Going to Change Anytime Soon

The low housing supply is causing rent and home prices to skyrocket, but inventory growth doesn't look like it's going to accelerate soon. Pandemic-related shortages and unfilled construction crew positions are keeping production rates slow.

COVID-19 didn't cause the skilled labor shortage—experts saw that coming from a decade away. However, it did accelerate the problem.

Pre-pandemic studies estimated that at least 41% of the construction workforce would retire by 2031—and the up-and-coming workforce wasn't joining fast enough to replace them. Now, the construction industry is facing a workforce shortage of 650,000.

And the availability of current inventory is unpredictable all over the country. The pandemic and post-pandemic work trends saw a mass exodus from major cities like New York City, Los Angeles, San Francisco, and Chicago. That left vacancies in metropolitan areas as renters and homebuyers flocked to warmer climates and (really) anywhere else.

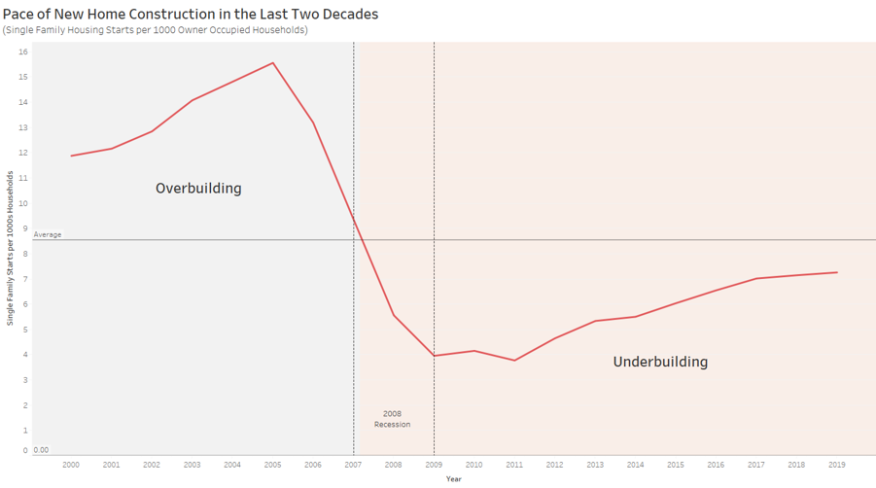

New home construction slowed after the 2008 recession as builders became more conservative. Now, we’re behind—way behind.

"Simply put, new home starts are not keeping pace with demand," says Javier Vivas, director of economic research at realtor.com. “The current inventory crisis and the need for 3.8 million new homes means a nearly insatiable appetite from potential buyers, especially in the lower end of the market.”

This new trend saw huge spikes in demand in markets like Florida, Arizona, and North Carolina—and with demand came huge rent increases. Yet, things are changing again.

As offices re-open, people are starting to migrate to the big cities. However, it's not necessarily the same individuals.

"I don’t think it’s necessarily [the same] people moving back," said Richard Barkham, head of Americas Research for the CBRE Group. "It might be a new generation graduating from college and going to work.” Regardless of who it is, cities are seeing a slow resurgence as public transportation and close proximities become less of a health risk factor.

Predictions (Not Guarantees) for the Future

Based on the data above, we have a few ideas of where the market is headed for the remainder of 2022 and into 2023.

Remember, we're not fortune-tellers—we're just real estate experts with a best guess. Take our predictions with a grain of salt.

The Seller-Buyer Gap Will Shrink

The housing supply is growing, which means homebuyers should have more options. However, mortgage rates have been on the rise, and they look to continue going up with Fed interest rate hikes.

Yes, mortgage rates are expensive at the moment. Yes, they're a lot higher than they were in 2021, but they're still lower than anything we saw from before 2008.

As home price growth slows and more inventory becomes available, the seller-buyer gap will begin to shrink. Sellers will still have the advantage in the short term, but we should hopefully see more opportunities for negotiation on the buyer's part.

Homes Will Turnover More Slowly

All of this will lead to fewer and slower transactions. Homes spent just an average of 18 days on the market in February this year, which is crazy low compared to 98 days in July of 2011.

However, high mortgage rates and home prices will slow things down. Fewer buyers in the market (with more options) should lead to less competition, which means people will take a bit more time before committing to an expensive investment.

Home Prices Will Continue Rising

Supply might be rising, but it's not enough to push down home prices. While home prices will continue growing, they'll grow at a slower rate—and we'll see less over-asking at jaw-dropping margins.

It's going to take a while for new builds to keep up with demand. Rent prices aren't going down, and it's almost more expensive to rent than it is to buy—which means people are more incentivized to buy right now.

Some Markets Will Experience More Drastic Changes

The states and cities that have experienced the most dramatic growth will probably see corrections in the near future. For example, we're already seeing price declines in hot markets like Phoenix, Salt Lake City, and San Antonio.

Nomad's Predictions for the Rental Market

Rent Price Growth Rates Will Rise

Rent prices have continued to break records throughout 2022, and that pace doesn't look like it will slow down this year. However, a lot of the changes will be market specific. Some areas will normalize, others will rise, and a few will drop.

Affordability Will Get Worse Before It Gets Better

Salaries aren't rising on pace with rent or home prices—not by a long shot. This is leading to a worsening affordability gap, and it's only going to get worse this year.

As rent prices go up, it makes it harder for renters to save enough money for a down payment on an eventual home purchase. The money they were putting into their savings account is now going to their monthly rental bill.

Big City Rent Prices Will Jump Again

New York just saw a rent increase (the sharpest in a decade), and other cities may follow soon. Major metropolitan areas saw rent freezes and laws against evictions during the pandemic, but things are loosening up for landlords.

While this puts more strain on tenants, rent increases finally help landlords who've been at risk of bankruptcy due to a lack of increases in the face of inflation and rising mortgage rates.

7 Ways to Navigate the Real Estate Market for Landlords

You have the data, and you have the predictions—now what? There are no single best answers for everyone, but there are good, better, and best decisions depending on your individual circumstances.

Here are a few ways you can navigate the current real estate market:

1. Continue Renting Your Property

Keep doing your thing. With rent prices rising across the country, you're in a prime position to rent your properties for top dollar. If you’ve already locked yourself into a low mortgage rate, you can keep making your monthly payments (and making a profit) with higher rent prices.

You can keep renting your property for the foreseeable future, but you definitely want to wait until you qualify for the 2-out-of-5-year rule before selling it.

Look at raising your prices to remain competitive with your local market. If you're nearing contract renewal time, look at locking in a better rate, as prices look set to continue rising.

Remember, it’s a hard market for renters. If you have a tenant you trust and respect, it might be worth keeping things as they are rather than outpricing tenants you want to stay. There’s a time and place for juicing as much money as you can and making the world a better place—and it’s up to you to find that sweet balance.

Nomad cares about tenants, too, and that’s why we offer Resident Rewards with flexible leases, 24/7 personal concierge, credit building assistance, and discounted brokerage commissions.

If you're on a month-to-month contract with your tenants, keep a close eye on evolving trends and numbers in your area. Keep an open line of communication with your tenants and let them know in advance if they can expect rent hikes. This will put them in a better position to deal with the increases, or it will give them sufficient time to find more affordable housing—and time for you to find a new tenant without suffering a vacancy.

While demand is making it easy to rent your property, it can be a lot of work remaining competitive and earning top dollar for your rental units. Let Nomad do the heavy lifting.

Nomad can protect your income with guaranteed rent, and optionally take care of marketing, leasing while you sit back and earn guaranteed rent every month. It's a passive way to make stress-free income in an active market.

2. Expand Your Rental Business With Another Property

Now might be a great time to purchase another piece of real estate. Yes, mortgage rates are higher than they were in 2021, but they're not insanely expensive—and you can always refinance later. Buyers with more cash to contribute can even hunt for deals with less competition.

Eventually, housing prices will come down, but don't wait for something like the 2008 market crash—we're (hopefully) not going to see anything like that. As home prices stabilize, there will be opportunities to buy properties with a higher cap rate than has been possible in the last few years.

Don't play the interest rate game. If you want to purchase another property, waiting on mortgage rates to drop is about as lucky as playing the slot machines. They may come down again, but it's not going to be as exaggerated as we saw before—and you have no idea when it's going to happen.

Keep your eye out for great opportunities, but don't overcommit if you can't afford it. Also, keep in mind the price of construction and renovations right now.

And think carefully about purchasing any fixer-uppers. Unless you're a handyperson who can take care of all the necessary repairs and upgrades, don't count on ready availability from contractors in your area. Some parts of the country have up to 12-month wait times (or more) for contractors.

Thinking about purchasing a property? Use the Nomad brokerage. We can help you buy, sell, or rent—all under one roof. You can even use our cash to ensure you win the deal. We can even provide you with an advance of up to 6 months of rent at closing that you can use towards repairs or renovations.

3. Turn Your Primary Home Into a Rental If/When You Move

You have a few options for your home if/when you decide to move. While you can sell the property and cash out, that might not be your best option.

If you haven't lived in the property for at least 2 out of the last 5 years, you might get hit with a hefty capital gains tax bill. Plus, with rent prices on the rise, renting your property could net you a nice monthly paycheck—especially if you have a low-cost mortgage from 2021 or before.

Home prices are rising (and don't show any signs of stopping), so the longer you hold onto your property, the more it'll likely be worth.

However, being a landlord is a lot of work, especially if you're moving across the country or hours away from your previous property. That's where we can help.

Work with Nomad, and we'll take care of everything you want us to. You don't have to worry about marketing the property, showings, tenant communications, maintenance, or rent collection—we take care of it all. Learn more here.

4. Sell Your Rental Property

While we don't know if (or when) a housing market decline will occur, it's still a historically great time to sell your rental property due to high property values in most markets. You may have to pay expensive capital gains taxes on the transaction (unless you qualify under the 2-out-of-5-year rule), but sometimes you need liquidated cash for other investment opportunities or life expenses.

Not sure if you should sell or rent? Fill out our form here, and we'll get in touch to help you make the best decision.

Selling your rental property to fund another investment opportunity? Consider doing a 1031 exchange—more on that next.

5. 1031 Exchange Your Property

Thinking of upgrading to a bigger, better investment property? Want to sell your property for one in a hot or up-and-coming market? Instead of doing a traditional sale and reinvestment, perform a 1031 exchange.

A 1031 exchange lets you swap your rental property for another like-kind asset without having to pay capital gains taxes. It's the best way to build long-term wealth while deferring your tax payments.

On the downside, 1031 exchanges can be tricky. There are rules and deadlines to navigate that make it notoriously difficult.

Need help tiptoeing through the IRS's landmines? We specialize in 1031 exchanges and have access to off-market inventory, meaning you can find the perfect replacement property after you sell to satisfy the IRS' 45-day identification rule.

6. Upgrade Your Property

While material and construction crew shortages are affecting the entire country, upgrading your property could be a lucrative way to increase your earning's potential. Renovating your property and adding amenities is a great way to negotiate higher monthly rent, and the increased earnings could easily pay off your investment in less than a few years.

Start looking for a contractor before you need one. Get on their schedule and begin asking for quotes. It's never too early to price things out, especially if you already know the renovations you have in mind.

7. Convert Your Property from a Short-Term to a Long-Term Rental

Short-term rentals have the opportunity to make more income, but they involve more risk and more work. You have to worry about marketing and cleaning the property day after day and week after week (as opposed to locking tenants into a 12-month contract).

You also have to worry about cancellations and vacancies. When nobody is staying in your short-term rental, you're losing money—and this can happen more often in the off-season at your destination.

Convert your property to a long-term rental to improve your cash flow reliability and decrease your workload. Once you have a paying tenant, you can worry less about vacancies, cleaning, and maintenance.

Here are a handful of the reasons to convert to a long-term rental:

Fewer Time Constraints: Go from day-to-day tasks to month-to-month or even year-to-year.

More Consistent Cash Flow: Every month, you know exactly how much income you can expect.

Utility Payment Tradeoff: Pass off expenses like internet, water, and electricity to your tenants.

Oversupply of Airbnb, VRBO, and Other Short-Term Rentals: There's a lot of competition for short-term rentals, and there's a lot of unfulfilled demand for long-term rentals.

Decrease in Short-Term Rental Demand: The pandemic showed how easy short-term rental demand can fluctuate—you typically don't have the same issues with a long-term unit.

Inconvenient Short-Term Renting Laws: Cities and counties are imposing more laws and licensing requirements on short-term rental properties.

Desire for More Reliable Tenants: Long-term tenants share a vested interest in the quality of your property, and they'll usually do their part to keep it neat, clean, and tidy (for the most part).

Let Nomad Do the Heavy Lifting

The current real estate market is chaotic—we'll be the first to tell you that. We're seeing more and more record highs when it comes to home prices, rent growth, inflation, and the like—so everything is up in the air at the moment.

Running a solo landlord business can feel overwhelming. Fortunately, you don't have to go it alone.

Work with Nomad for all your real estate needs. We can help you buy, rent, or sell—all under a single roof. Our team of experts has 20+ years of experience, and we can help you purchase the perfect property, sell your home for top dollar, or create an income-generating rental.

Want to learn more?

Reach out to the team and see how we can help.

Reach New Heights

Get a no-obligation estimate for Guaranteed Rent, and see how Nomad can help you earn more with less stress

Unlocking economic opportunity for everyone.

Already a customer with us? Login to your portal

© 2024 Nomad Labs, Inc. All rights reserved.

Nomad Brokerage LLC

Nomad Brokerage California Inc

California DRE # 02230490

Consumer Protection NoticeTREC Consumer Protection Notice